This article is contributed by Patrick Tay, Labour Member of Parliament and NTUC Assistant Secretary-General. Any extracts must be attributed to the author. 19 January 2020.

The year 2020 was meant to be the start of a decade filled with great changes and optimism until the COVID-19 pandemic struck and turned some aspects of our lives chaotic. Amidst the uncertainties, there were opportunities too. It is heartening to witness many industries, companies and individuals adapt to the new normal, even when the transformation was difficult and unprecedented. As we venture into 2021 with a clean slate, it is opportune for us to reflect on the several, occasionally large, changes that occurred in the financial services sector in 2020.

I remember the first time I was greeted by a robot when entering a bank and was intrigued by the scene that unfolded before me – this was the precursor to the advancements in technology, in ways we were unaware of. Today, technology in businesses is no longer a rare sight as more industries adopt and incorporate technology in their operations.

In one of my previous blog posts on the Financial Services sector, titled ‘Financial Services Sector – Disruption, Displacement & Development’, I touched upon the effects of disruption, displacement and development following the advent of automation and technology. The trend has not changed. In fact, some may argue that the pandemic has compounded the rapid digitalisation of our businesses and workforce.

Today’s conundrum is less about whether technology would affect our workforce but more on how technology is revolutionising it.

Asia is predicted to emerge as the key centre of technological-driven innovation. COVID-19 has contributed largely to Asian countries adopting cloud services. China is forecasted to account for one-third of the cloud computing market in Asia Pacific by 2023, while India and Japan are expected to make up another one-third.

With the increased adoption of cloud services and technological advancements, there will be a growing demand for data centres in Asia. Singapore plays an important role here, as some of the new cloud services are established in our country. Amazon Web Services (AWS), Google Cloud Platform (GCP), Facebook and Alibaba Cloud have expanded their data centre infrastructure in Singapore to support growing user bases. As such, Singapore boasts one of the most mature data centres markets in the world. Some of these companies have also announced plans to expand and launch similar strategies in neighbouring countries. It is heartening to see investors recognise the potential of the region.

For the masses, the 5G network would be most relevant on our new iPhones and Android devices but these networks are expected to be more ground-breaking and impactful than its predecessors. As 5G proliferates the market, so does the demand for high-performance and reliable semiconductor chips. Today, only two companies in the world can manufacture state-of-the-art semiconductors – Taiwan Semiconductor Manufacturing (TSMC) and Samsung Electronics.

While there is still a long way to go, Asian countries are on the trajectory of becoming a key technological hub with great competitive edges. Singapore has been preparing herself for large-scale, strategic technological advancements in certain industries. For instance, the new Tuas Mega Port will feature key innovations such as unmanned and automated yard cranes, drones and transport. State-of-the-art technologies are being introduced into specific industries and we can expect similar plans being rolled out across industries in the future.

Emerging Trends, Jobs and Skills in the Financial Services Sector

Remember the robot that greeted me at the entrance of a bank? Technological advancements, and its benefits, have transformed our financial services sector significantly. Let me share a few of these.

Robotic Process Automation (RPA)

RPA has evolved significantly to help financial institutions lighten manual processes with little subjective judgement. Financial institutions have often adopted RPA as a cost-savings measure to perform routine and high-frequency tasks.

RPA offers greater accuracy, consistency and quality when completing certain tasks, minimising human error in manual processes. Moreover, RPA is also capable of generating a full audit of process flows, actions and exceptions. Additionally, RPA is compatible with in-house or third-party applications and can be deployed by companies without further investments in existing infrastructures.

For example, United Overseas Bank (UOB) has ‘employed’ a virtual employee, Amy, to support their Trade Finance Operations and process requests for Letters of Credit by corporate customers. Upon extracting the data, Amy the bot would enter the information into the Finance of International Trade Automated System for approval. With the help of Amy, a task that would normally require 240 seconds takes only 40 seconds to complete.

Advanced Analytics (AA)

In a time when we accumulate copious amounts of data each day, organisations are actively seeking to increase their analytics capabilities to gain a competitive edge over their competitors.

Financial institutions are tapping on advanced analytics to scrutinise behaviour, sentiments, data, text, networks and clusters. Perhaps one of the most powerful features of advanced analytics is the ability to develop an understanding of underlying relationships between inputs and outputs to make predictions and drive decision-making for operations within the industry.

For example, DBS was one of the few pioneering Singapore banks to use data and advanced analytics in detecting fraud anomalies through transaction trends, red-flagging odd trade flows and triggering further analysis.

Artificial Intelligence (AI)

AI is not foreign to most of us in this heavily digitised era. The use of AI and machine learning can be adopted to deduce business processes from past transactions and make real-time deductions.

Many leading financial institutions are seeking opportunities by developing in-house capabilities or partnering with firms that have mature systems to tackle their challenges. In a recent research conducted by Experian, which surveyed 3,000 consumers and 900 executives working in financial services, 78% of organisations already engaged in AI to cope with market volatilities.

In the face of such rapid technological developments, it’s no wonder that workers like you and I would be fearful. Over lunch, one day, one of my peers remarked, “What would you feel if you see a robot instead of me behind my desk one day?”

However, the road ahead for workers is less gloomy than expected. The adoption and incorporation of technologies into business operations does not make us obsolete or redundant. There is comfort in knowing that there will always be a demand for human expertise, interaction and touch. Financial institutions would still require the innate creativity and innovation that we humans possess. Despite all the strengths of automation and AI, there will still be the need for data analysis and data interpretation and beyond by workers.

The financial services is a growth sector, expected to create 1,800 new jobs and 2,000 traineeships by June 2021 in the sector. The most in-demand positions include software developers and data, business or system analysts. There is little doubt that we will continue to see surges in the demand for talents to fill these emerging job roles in the financial services sector in the next few years.

Financial institutions will continue to find themselves competing with companies outside of the financial services industry for data talents. Instead of the displacement of workers by automation, we have once envisioned, new roles are being created in the financial services workforce.

While robots may replace workers in routine and repetitive tasks, new channels of work, roles and jobs have and will continue to emerge. Industries are innovating by consolidating and converging smaller job roles into higher-value jobs, augmented by technology. For example:

- Branch Tellers + Customer Service Officers + Relationship Managers → Digital Ambassadors

- Business Analysts + Data and Analytics Officers → Citizen Data Scientists

- Cloud Operations Officers + Cybersecurity (IT) Officers → Cloud and Embedded Security Specialists

- Compliance Officers + IT Developers → Technology Compliance Officers

Beyond the technology function, there is healthy demand for jobs across different business lines, including consumer banking, corporate banking, private banking and wealth management. These jobs are in three broad categories:

- Business roles: relationship managers, product advisory, and portfolio management;

- Control roles: customer due diligence, compliance, and risk management;

- Transformation roles: digital transformation, innovation and process excellence.

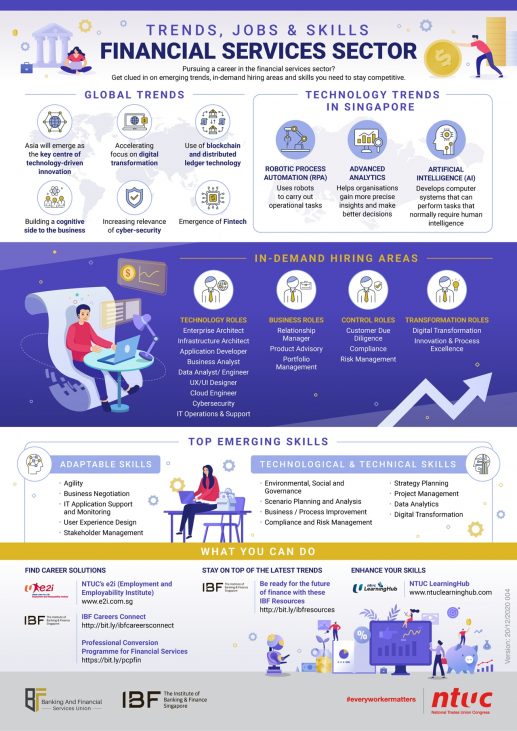

Together with the Institute of Banking and Finance (IBF) and Banking and Financial Services Union (BFSU), NTUC has put together an infographic to highlight the emerging trends, jobs and skills in the financial services sector that you may be interested in. You can refer to the infographic below:

Our journey ahead

The top emerging skills in the financial services industry are aligned strongly with the transformation of the sector. Adaptable skills such as Agility, Business Negotiations, IT Application Support and Monitoring and Stakeholder Management emphasise the shift from providing impersonal, mass financial solutions towards tailored, value-added financial services in this era of digitalisation.

Workers would also need to develop Environmental, Social and Governance (ESG) awareness, scenario planning and analysis, strategy planning and project management skills to gear up for the new and evolving jobs in the financial services sector.

We should take advantage of this opportunity to change and evolve along with the times. The pandemic has shaken up our lives, but it is up to us to take charge and view it as a gateway to greater success for ourselves and businesses.

No one knows what the future looks like, except that the road ahead is paved with technological advancements and changes. Industry transformation and post-pandemic changes may look daunting, but they aren’t impossible to overcome. New skills will lead you to greater heights and the skills you already possess will not fail you. To stay relevant, it is important to continue to deepen your current skills and develop new skills.

Thinking back, amidst the downturns and uncertainties that plagued 2020, we were resilient. Looking forward, this resilience will be what guides us out of the woods, in the year ahead and the years beyond. So, let us come together and collectively build back better.

The Labour Movement remains committed to walking alongside all workers in their journey. Individuals with concerns may approach NTUC’s e2i (Employment and Employability Institute) to discover career solutions or to start your skills upgrading journey. I strongly encourage all workers in the financial services sectors to join our Banking and Financial Services Union (BFSU). Members can look forward to discounts to seminars and training courses, as well as access to networking opportunities and selected events.

So, are we ready to transform yet?