Older workers will soon get more support when the Government raises the ages for retirement, re-employment and the CPF rates.

After consulting more than 1,500 stakeholders, the Tripartite Workgroup on Older Workers has made public its recommendations on 19 August 2019.

The workgroup consists of representatives from unions, employers and the Government.

The Government has accepted all 22 recommendations, and Prime Minister Lee Hsien Loong spoke at length about the issues at the National Day Rally.

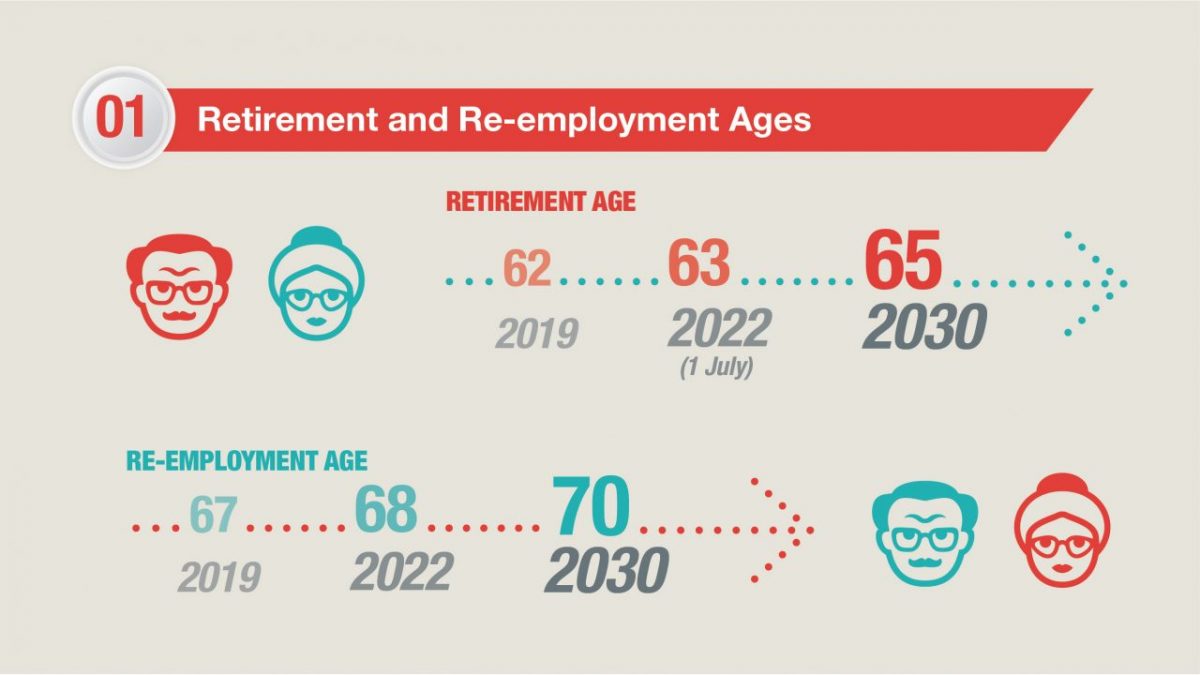

By 2030, the target is to raise the retirement age to 65 and the re-employment age to 70.

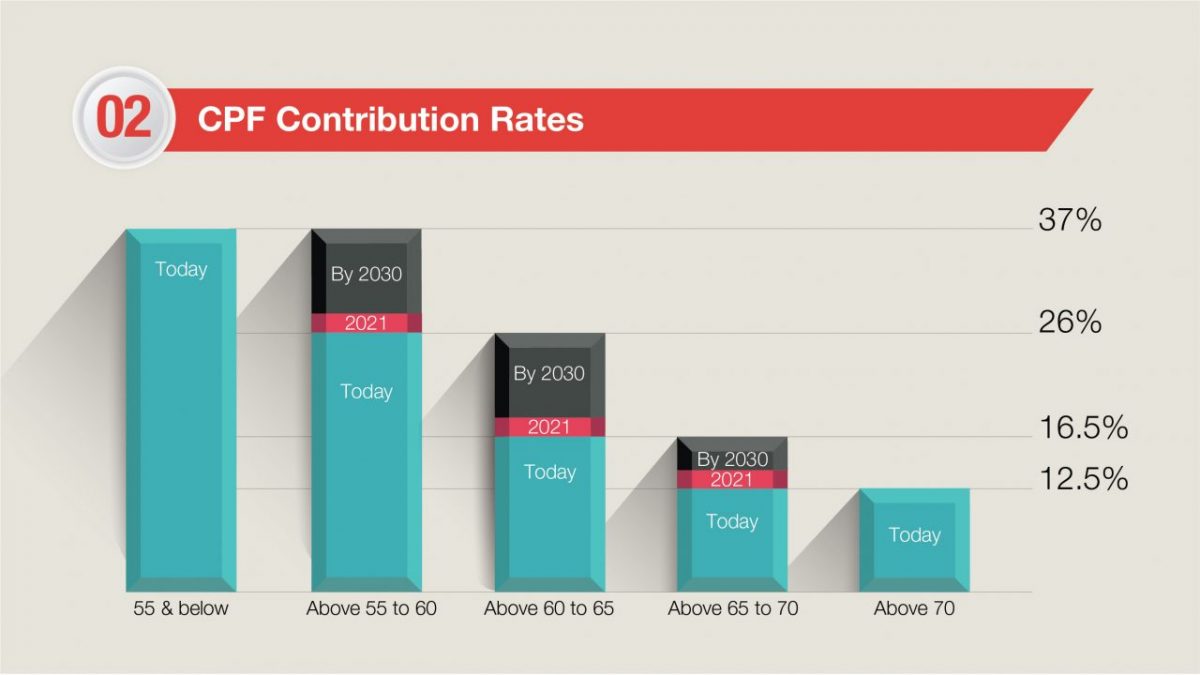

For CPF contribution rates, the plan is to raise the contribution rates for those between 55 to 60 to be the same as those under 55. The rate for those below 55 is currently 37 per cent.

Let’s zoom in on some of the recommendations and take a closer look at what’s in store for older workers.

Retirement and Re-employment

Although the retirement and re-employment age will be raised by three years, this will be done gradually over the next decade.

The workgroup said that this would give enough lead-time for businesses to plan.

The first move will be to increase the retirement and re-employment age to 63 and 68 first. This will take effect from 1 July 2022.

This means you will be affected by the retirement age increase if you were born after 1 July 1960. And you will be affected by the re-employment age increase if you were born after 1 July 1955.

The Government also committed to raising the retirement and re-employment age first.

As part of the Government’s move to get the ball rolling, those in the civil service will see their retirement and re-employment ages raised to 63 and 68 respectively in 2021 instead of 2022.

Although subsequent increases should be on a yearly basis, the exact timing of the future moves will be decided later. This is to enable the monitoring of the outcome of the first move in 2022 and consider the economic conditions, according to the workgroup.

Duration of Re-employment Contracts

Re-employment contracts will continue to have a duration of a minimum of one year.

However, the workgroup urged employers to offer re-employed workers longer contracts beyond the stipulated minimum.

Wage Offset Scheme

Currently, the Special Employment Credit helps to raise the employability of older workers and provides employers with a wage offset when they hire Singaporeans aged 55 and above and earning up to $4,000. However, this scheme will expire in 2020.

The continuation of the wage offset will show the Government’s commitment to support employers with the changes, said the workgroup.

Reducing Work Intensity

The tripartite workgroup also urged employers to provide part-time re-employment opportunities.

Doing so will help older workers continue to stay healthy and retain an income, while companies will be able to continue to leverage on a pool of skilled and experienced workers.

CPF Contribution Rates

Although the plan is to raise the contribution rates of those in the 55 to 60 age bands to 37 per cent, other age bands will also see an increase in their contribution rates by 2030.

Those above 60 to 65 will eventually see an increase to 26 per cent from the current 16.5 per cent, while those above 65 to 70 will see an increase to 16.5 per cent from the current 12.5 per cent.

The first move will start on 1 January 2021. Those above 55 to 65 will see their contribution rate increase by 2 percentage points – 1 per cent from the employer and 1 per cent from the employee. Those above 65 to 70 will see an increase of 1.5 percentage point – 0.5 per cent from the employer and 1 per cent from the employee.

Withdrawal ages and policies won’t be changing – you will still get to withdraw some money at 55, and start receiving your CPF payouts at 65.

However, it’s important to note that 2030 is only a target, as there might be a need to defer the contribution rates increases due to economic conditions.